Below are links, information, and suggested responses to H.R. #1226 (JUST ACT), currently before the U.S. House Foreign Affairs Committee. Please become informed and be ready to take action. Our representatives in Washington need to be made aware of the issues involved with this bill. If passed, as it was in the Senate in December 2017 with no discussion, this legally flawed bill could be potentially destructive to Poland’s economy.

Feel free to share and copy information provided.

1. THE POLISH AMERICAN CONGRESS DOES NOT WANT THE JUST ACT OF 2017 APPLIED TO POLAND

A dangerous United States Congressional Resolution for Poland soon may be enacted. The full title of this resolution is: “Justice for Uncompensated Survivors Today (JUST) Act of 2017”. This

resolution, the JUST ACT OF 2017 has two components: Senate Resolution 447 (S. 447), and House of Representatives Resolution 1226 (H.R. 1226).

The United States Senate voted-up without opposition, on 12 December 2017, S. 447. Now the Foreign Affairs Committee of the House of Representatives is considering H.R. 1226.

In a general way, the JUST ACT OF 2017 requires the United States Government to observe how 46 countries are fulfilling their obligations to implement numerous agreements on compensation

and/or restitution of both private and communal moveable and immovable property, and other commitments, like the maintenance of historic sites and monuments.

The specific purpose of the JUST ACT OF 2017 is: “To require reporting on acts of certain foreign countries on Holocaust era assets and related issues, and for other purposes.” This would require

the United States Government to observe and monitor, pressure is a more honest description, compliance by Poland and other countries that participated in the Prague Holocaust Era

Conference’s Terezin Declaration (2009). Poland is the principal target of the JUST ACT OF 2017, because the largest portion of private property formerly owned by Jews (which amounts to 20% of the total of despoiled and nationalized private property), and now claimed by Jewish individuals and organizations, is located in today’s Poland. This private property on conquered Polish territory, called World War II era private property, was first despoiled by Nazi Germany and then nationalized by the communists.

Compensation payments to redress these crimes against private property should be sent to Berlin and Moscow, not Warsaw.

Moreover, Poland already satisfied, by acceding to a 1960 bilateral treaty, all claims for private property in Poland owned by United States citizens before September 1, 1939. Today, the United

States Congress and the Office of Holocaust Issues in the Department of State is pressuring Poland to pay lump-sum compensation on behalf of transnational Jewish organizations like the

World Jewish Congress, and the Conference on Jewish Material Claims Against Germany. The World Jewish Congress recently opened an office in Warsaw. This pressure on Poland is

unwarranted. The exceptional role of Poland and the Poles in World War II and her armed resistance to the imposition of communist dictatorship by the Soviet Army makes a moral and

historical case for NOT applying H.R. 1226 to Poland.

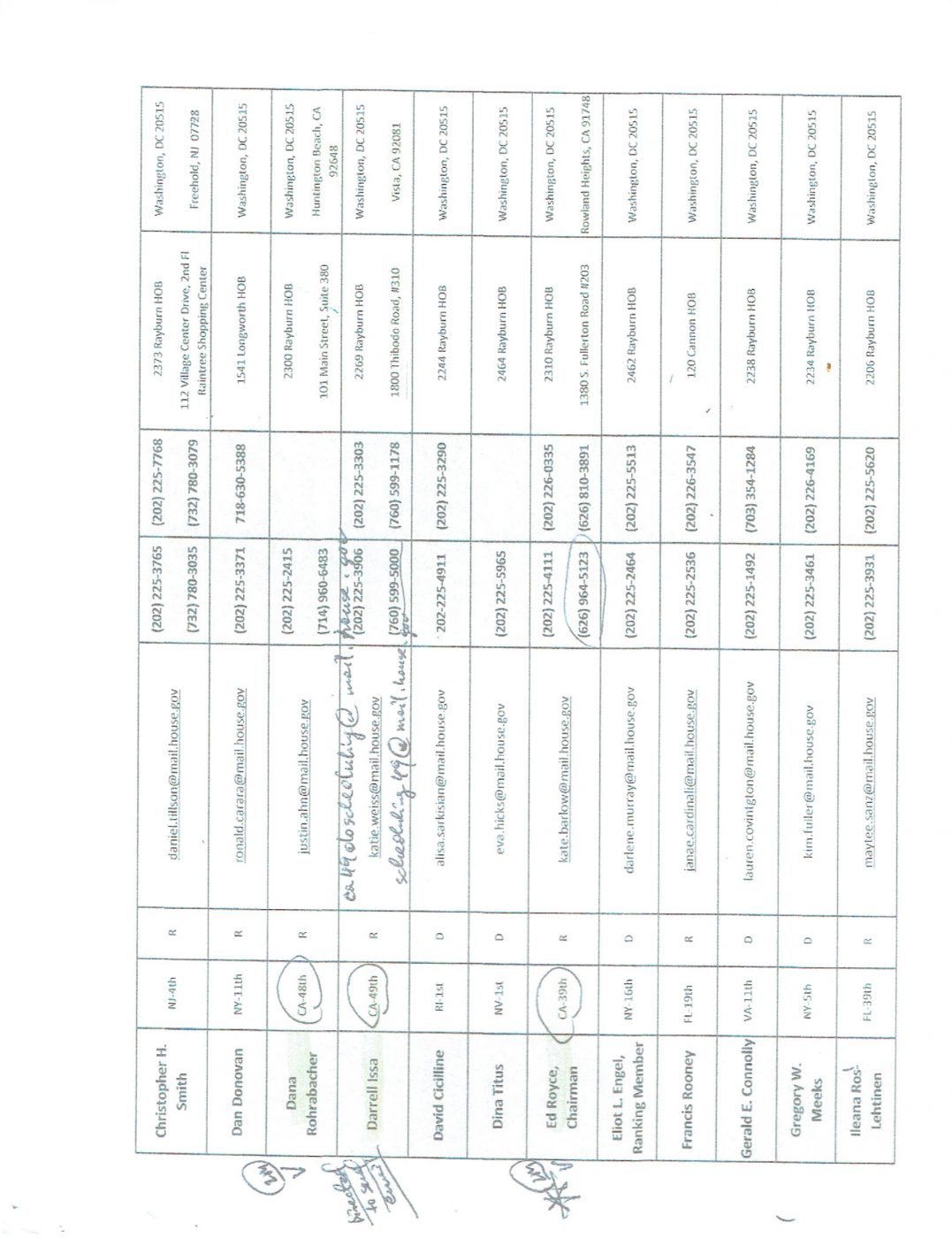

Two members of the House of Representatives introduced H.R. 1226: Congressman Joseph Crowley (D-NY14), and Congressman Christopher Smith (R-NJ4). In 2008 Congressman Crowley

introduced a House of Representatives Resolution calling on Poland to pay lump-sum compensation for World War II era Jewish private property. In 1991, Congressman Smith

organized the Congressional Caucus on Poland to pressure Poland into paying lump-sum compensation. Moreover, in 2005, Congressman Smith introduced a House of Representatives

Resolution calling on Poland to pay lump-sum compensation.

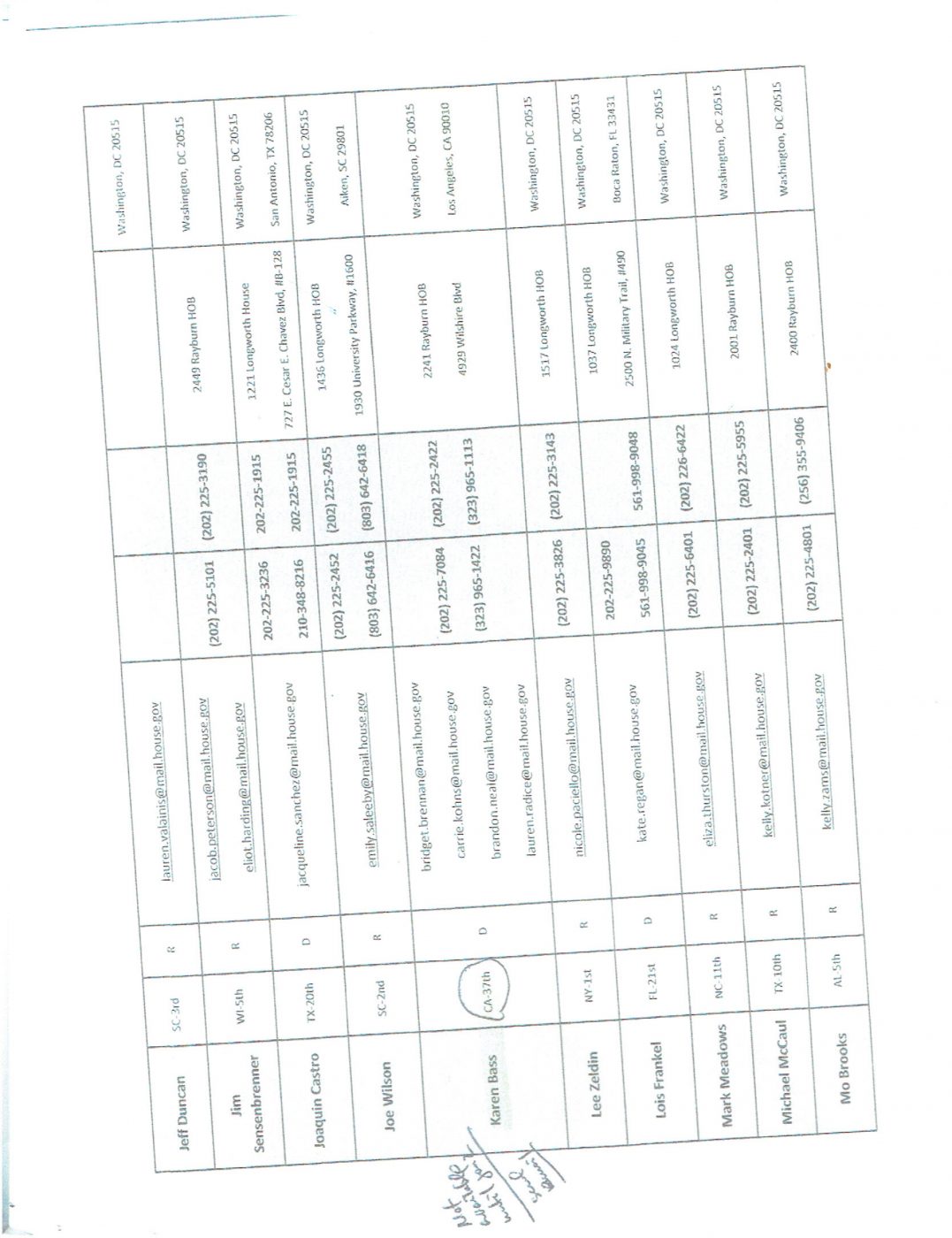

This is why the President of the Polish American Congress (PAC), Mr. Frank J. Spula, wrote a forceful letter, addressed to Chairman Ed Royce, and by extension his 46 colleagues serving on

the House Foreign Affairs Committee. This letter strongly encourages these 47 members of the House of Representatives NOT TO APPLY H.R. 1226 to Poland. If they ignore this sound advice

from the PAC, then Polish Americans will not vote to re-elect these members of the House of Representatives on 6 November 2018 in Congressional Elections.

John Czop

Director of Policy Planning (PAC)

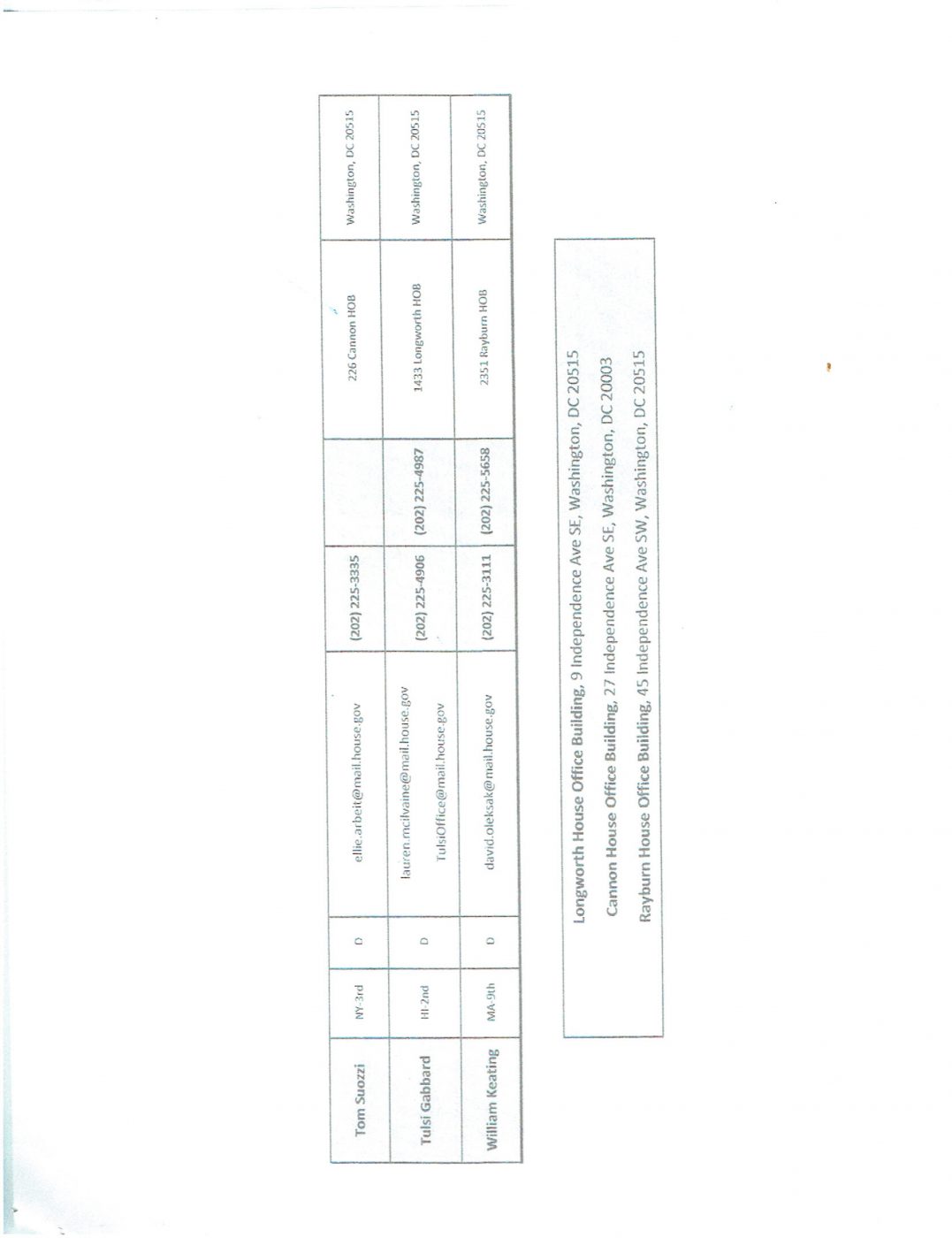

2. PAC Action Alert for House Foreign Affairs Committee Members (including full list of U.S. Senators and Congressmen): (There are no Michigan congressmen on the Foreign Affairs Committee currently; should the bill go to a vote before the whole House, then every congressman would need to be contacted and informed)

http://www.pac1944.org/ameragenda/ActionAlert.1801.htm

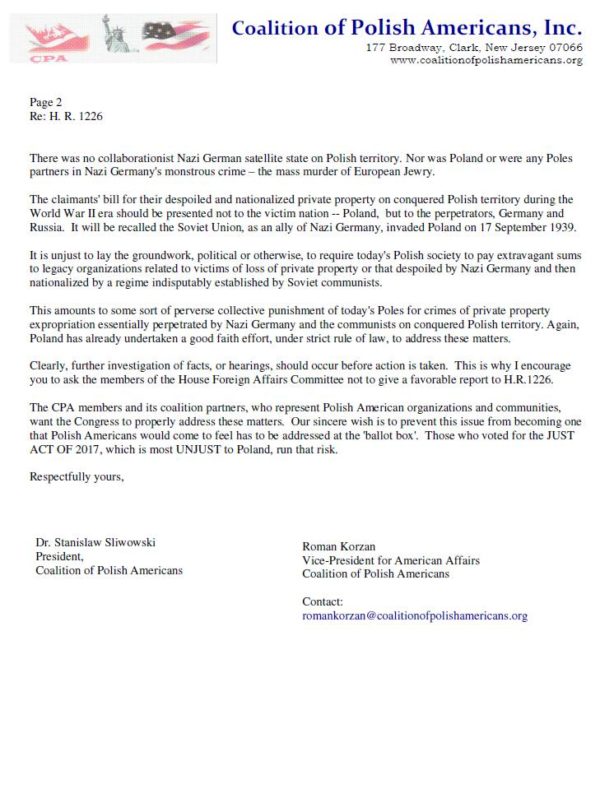

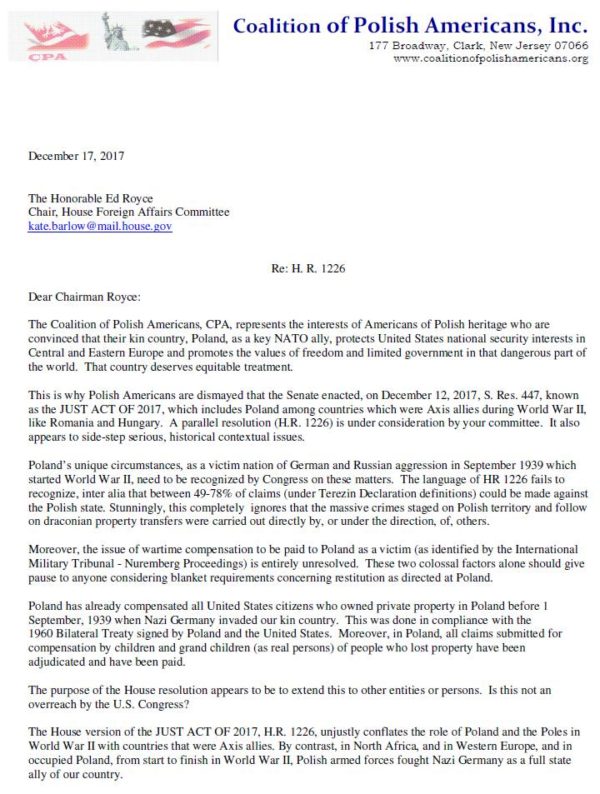

3. “Coalition of Polish Americans” letter to Committee Chairman Royce

4. Have your name, or that of your organization, added to a letter to House Foreign Affairs Committee, contact Edward Jesman, president@pacsocal.org, 310-291-2681 or edward@jesman.com.

Please read below:

On January 8, 2018 24 leaders of the Polish community in the USA, among others from organizations like the Polish American Congress sent a letter to the Members of Congress urging the congressmen and congresswomen to reject the Act H.R. 1226:

Dear Members of the House Foreign Affairs Committee,

On December 12, 2017 the U.S. Senate approved Bill S.447, known as “the Justice for Uncompensated Survivors Today (JUST) Act of 2017”. The House Bill H.R.1226, which mirrors the U.S. Senate bill S.447, is presently awaiting evaluation of the House Foreign Affairs Committee

Attached is a legal evaluation (see link above), of the proposed House Bill H.R.1226 that we are respectfully submitting for your review. It is our position that H.R.1226 is logically and legally flawed, as per the attached legal analysis. Moral, historical and political dimensions must be carefully considered as well.

A follow up letter, and a full list of the Polish American signatory organizations monitoring this bill, shall follow within the next several days.

We urge you to reject H.R.1226.

Sincerely, Edward Wojciech Jeśman, President

Polish American Congress of Southern California Los Angeles, California

Andrzej Prokopczuk, President

Polish American Congress of Northern California San Francisco, California

Jerzy Bogdziewicz, President

Polish American Congress of Florida Pompano Beach, Florida

Michael Nidzinski, President

Polish American Congress of Illinois Chicago, Illinois

Ann Bankowski, President

Polish American Congress Michigan Division Hamtramck, Michigan

Wieslaw Wierzbowski, President

Polish American Congress of Eastern Massachusetts Quincy, Massachusetts

Walter Wiesław Gołebiewski

Polish American Congress Florida Western Division Corp. New Port Richey, Florida

James L. Ławicki II, President

Polish American Congress Western New York Division Inc. New York

John (Jan) M. Malek, Founder & President

Polish American Foundation for Economic Research and Education (PAFERE) Torrance, California

Stanislaw Matejczuk, Head Coordinator Polonia Semper Fidelis

New Mexico

Waldemar Biniecki, CEO

Pax Polonica Foundation Manhattan, Kansas

Peter Pachacz, President

Pulaski Association Business and Professional Men, Inc. Brooklyn, New York

Richard Mleczko, President

East Bay Polish American Association Martinez, California

Adam Gromek, President

Polonian Cultural and Pastoral Center Sacramento, California

Leszek Pawlik, CEO

Polonia Institute Torrance, California

Witold Rosowski,

Polish Heritage Council of North America New York, New York

Zygmunt Staszewski, Co-Chair

Polish-Jewish Dialogue Committee New York, New York

Walter Wiesław Gołebiewski

World Research Council on Poles Abroad Florida

Jerzy W. Rozalski

Polish Varieties Radio WNZK Detroit, Michigan

Natalia Kaminski Polish Radio Hour

Los Angeles, California

Mary Lou T. Wyrobek, President

Polish Singers Alliance of America

Ania Karwan, National Director

Polish American Congress of Southern California Los Angeles, California

Edmund Lewandowski, National Director

Polish American Congress of Northern California San Francisco, California

Halina Koralewski

Achilles Poland International Ambassador New York, New York

Zbigniew Koralewski, National Director

Polish Singers Alliance of America Long Island, New York

Cc:

President of the United States, Donald Trump

Vice President of the United States, Mike Pence

Secretary of State of the United States, Rex Tillerson

President of Poland, Andrzej Sebastian Duda

Prime Minister of Poland, Mateusz Morawiecki

Minister of Foreign Affairs of Poland, Jacek Czaputowicz

Marszalek Sejmu, Marek Kuchciński

Marszalek Senatu, Stanisław Karczewski

5. Summary of Legal Objections to the Bill:

Legal Objections to Bills S.447 and H.R.1226 January 4, 2018

- BILLS 447 AND H.R.1226 VIOLATE INTERNATIONAL TREATY AND LAW

The Justice for Uncompensated Survivors Today Act of 2017, S. 447, passed the Senate on December 12, 2017. A related House Bill H.R.1226 was introduced in the US House of Representatives on February 27, 2017. Both S. 447 and H.R. 1226 (the “Bills”) are now before the Committee on Foreign Affairs of the House of Representatives. The texts of the two Bills are similar and in parts identical. The Bills call on “countries of particular concern” relative to the Holocaust Era assets and related issues to: 1) return to the rightful owner any property, including religious or communal property, that was wrongfully seized or transferred; 2) provide property or compensation for heirless property in order to assist needy Holocaust survivors, to support Holocaust education, and for other purposes.

- Compensation for private property in Poland already paid to rightful owners

In calling for the return to the rightful owner of a property that was “wrongfully seized or transferred,” the Bills violate the Agreement between the Government of the United State of America and the Government of the Polish People’s Republic regarding claims of nationals of the United States signed at Washington on July 16, 1960, and registered with the United Nations by the United States of America on January 6, 1961 (“1960 Treaty”).

Under the 1960 Treaty, Poland paid the United States $40 million in full settlement of claims of nationals of the United States for nationalization or other taking of property, appropriation or loss of use of their property and debt owed by enterprises taken over by the State.1 The $40 million paid pursuant to the 1960 Treaty represents over a billion dollars in 2017. Hence, this substantial compensation was intended to settle property claims against Poland by US nationals. In accordance with Article IV of the 1960 Treaty, the United States agreed to fully indemnify Poland for any property claims of US nationals, which occurred on or before the entry into force of the 1960 Treaty.2

1 Art. II of the 1960 Treaty provides compensation for the following: (a) the nationalization or other taking by Poland of property and of rights and interests in and with respect to property; (b) the appropriation or the loss of use or enjoyment of property under Polish laws, decrees or other measures limiting or restricting rights and interests in and with respect to property, and (c) debts owed by enterprises which have been nationalized or taken by Poland and debts which were a charge upon property which has been nationalized, appropriated or otherwise taken by Poland.

2 Article IV of the 1960 Treaty provides: After the entry into force of this Agreement the Government of the United States will neither present to the Government of Poland nor espouse claims of nationals of the United States against the Government of Poland to which reference is made in Article I of this Agreement. In the event that such claims are presented directly by nationals of the United States to the Government of Poland, the Government of Poland will refer them to the Government of the United States.

On March 31, 1966, the Foreign Claims Settlement Commission of the US completed its administration of the Polish Claims Program pursuant to the 1960 Treaty and submitted a final report to various committees of Congress. Awards granted under the Polish Claims Program totaled $100,737,681.63 in the principal amount plus interest in the amount of $51,051,825.01.

Accordingly, in light of the contractual obligation of the United States to provide indemnity to Poland for private property claims, the enactment of the Bills that direct the US Secretary of State to pressure Poland to pay further private property claims violates the contractual obligation of the United States.

Also, it shall be noted that between 1948 and 1971 Poland concluded property restitution and compensation treaties not only with the United States but also with Austria, Belgium, Canada, Denmark, France, Great Britain, Greece, Holland, Luxembourg, Norway, Sweden and Switzerland. All claims for property located in Poland by the citizens of these countries have been since settled in full and discharged.

Furthermore, since 1989, all legitimate property claims of private individuals can be freely pursued before the Polish courts in accordance with the provisions of the Civil Code. Every person regardless of their nationality or ethnic origin may enforce their property and inheritance rights before the Polish courts in accordance with the procedures of the Code of Civil Procedure. Hence, every individual with a right title can file a request for declaration of the acquisition of the inheritance. Thousands of people with legitimate title claims – regardless of their ethnic origin – have recovered their properties in Poland pursuant to the private property law.

- Religious and communal property returned or compensated for in Poland

The return of Jewish religious and communal properties has been implemented in Poland pursuant to the 1997 law on the relationship between the Polish State and Jewish religious organizations.3 On the basis of this unprecedented legislation, Poland granted the Jewish minority broad decision- making powers in the implementation of this legislation. The Commission for the Jewish Communities Affairs carried out the restitution of Jewish religious and communal properties program in close cooperation with the Union of Jewish Communities.4 Over 2,500 communal properties, including synagogues, cemeteries and cultural centers, have been either returned or compensated for based on the Polish 1997 law.

Accordingly, practically all religious and communal properties with adequately documented ownership have been either returned or compensated for by now. Therefore, claims for this type of property restitution have been settled in Poland.

- Restitution of heirless property is against the law

If there are no heirs, the property is not “wrongfully seized or transferred.” It escheats to the state. That’s the law in every country. The Bills introduce a precarious precedence of “heirless property” compensation that is contrary to the Western legal tradition and principles of jurisprudence. In S.

3 Law dated February 20, 1997, DZ. U. 1997 No. 41 Item 251.

4 Art. 32.1 of the 1997 Law .

447, the goal and objective relative to heirless property is “the provision of property or compensation to assist needy Holocaust survivors, to support Holocaust education, and for other purposes. . .” H.R. 1226 states the goal and objective as “the restitution of heirless property to assist needy Holocaust survivors, and for other purposes . . .”

“Restitution of heirless property” is an aberration by definition. “Restitution” means the restoration of something to its rightful owner. If the property is “heirless” then, by definition, restitution of the property to the rightful owner is impossible. The property might have been “wrongfully seized or transferred” originally, but if the property is now heirless, it escheats to the state. That’s the law everywhere, including the United States.

The Bills call on the Secretary of State to present reports that are to address “wrongfully seized or transferred Holocaust era assets.” Hence, such reports should not include “heirless property” which always and everywhere escheat to the state; such escheat being lawful and legal, regardless of whether the property was earlier wrongfully seized or transferred.

This issue is of crucial importance to Poland since most of the heirless property claims are against Poland. Creating ex post facto a legal precedent of property restitution to “non-heirs” for “other purposes” amounts to extortion of funds from “other” uncompensated victims of the German WWII genocide. Such scheme treats the Polish taxpayers, who themselves are victims of the German genocide and wrongful seizure of property, as those guilty of the Jewish Holocaust, hence it is unconscionable.

- Multiple payments for the same claims are wrong in law and equity

Poland has implemented numerous laws and procedures under which WWII property claims have been effectively pursued. Since 1951 Germany has paid the equivalent of over 100 billion dollars to Jewish individuals, Jewish organizations and the State of Israel. The German payments covered all of the Jewish property seized and expropriated by Germany during WW2, including the immovable property located on the Polish territory conquered and occupied by the Third Reich.

- THE BILLS ARE UNCONSTITUTIONAL

The US Congress does not have the constitutional power to enact either of the two Bills.

Rule XII Clause 7(c) of the House of Representatives requires that all bills (H.R.) and joint resolutions (H.J.Res.) must provide a document stating “as specifically as practicable the power or powers granted to Congress in the Constitution to enact the bill or joint resolution” to be accepted for introduction by the House Clerk.

According to the Constitutional Authority Statement, Congress has the power to enact the Bills pursuant to Article I Section 8 Clause 3 of the Constitution of the United States.5 The cited clause

5 See: https://www.congress.gov/bill/115th-congress/house-bill/1226 From the Congressional Record Online through the Government Publishing Office. By Mr. CROWLEY: H.R. 1226 – the following: Article I Section 8 Clause 3 [Page H1355].

of “Article I Section 8 Clause 3” is commonly known as the Commerce Clause,6 which gives Congress the power “to regulate commerce with foreign nations, and among the several states, and with the Indian tribes.”

Clearly, neither S 447 nor HR 1226 are related to the regulation of commerce. Unless, perhaps, it is intended to gather information, under Congress’ investigatory power, to be used in future legislation that would impose sanctions on countries that are deemed not to have made sufficient progress towards the Holocaust (Shoah) Era restitution claims. If so, this purpose should be stated explicitly in HR 1226.

- THE BILLS ARE DISCRIMINATORY IN NATURE

The Bills make reference to the Terezin Declaration adopted at the 2009 Holocaust Era Assets Conference held in Terezin, Czech Republic. The Terezin Declaration adopted the phrase, “Holocaust (Shoah) survivors and other victims of Nazi persecution” throughout, except under the section entitled “Immovable (Real) Property,” in which a more narrow definition of victims i.e. “Holocaust (Shoah) victims” is used. The use of “Shoah” is intended to restrict “Holocaust” to Jews only and not include other victims.

The United States shall not discriminate against racial, ethnic or religious groups whose members may be in the exact same situation as Jews. Approximately 5 million non-Jews (mostly Christians) were killed by the Germans. In particular, close to 3 million Poles were killed in WWII by Hitler’s Germany and the Soviet Union, and it is estimated that about 80% of the potential property claims would be by ethnic Poles while about 20% by ethnic Jewish. The “other victims” in particular the Polish victims of German extermination, must be explicitly included in the restitution claims to avoid misunderstandings and complaints of favoritism, undue influence and outright discrimination.

Both Bills would require the US Secretary of State to submit a report “that assesses and describes the nature and extent of national laws and enforceable policies” of “covered countries” regarding the “identification and the return of or restitution for wrongfully seized or transferred Holocaust era assets.” The report would also assess and describe the covered countries’ progress towards meeting the goals and objectives of the 2009 Holocaust Era Assets Conference (S. 447), or the 2009 Terezin Declaration on Holocaust Era Assets and Related Issues (H.R. 1226).

The Bills give the Secretary of State in cooperation with the Holocaust Envoy the power to determine, “in consultation with expert nongovernmental organizations” whether the proposed law applies to a particular country. The term “expert nongovernmental organizations” is one of several unacceptable ambiguities in these Bills. Requiring the Secretary of State or Holocaust Envoy to consult with undefined NGOs before choosing “covered countries” gives the Secretary or Envoy too much discretion and invites claims of discrimination of ethnic Poles and the Polish American community.

6 https://www.law.cornell.edu/wex/commerce_clause.

The NGOs that are to be consulted in designating “covered countries” should be explicitly named. As most of the potential claims will involve Polish properties, Polish-American NGOs shall be clearly identified for consultation, and Poland should be given full opportunity to be heard. Poland and the Polish Americans should give input and present their position regarding the issues involved before any decision to apply the Bills to Poland is made.

- THE BILLS ARE DUPLICATIVE OF ESLI STUDY

The US Secretary of State report required by the Bills would be duplicative of a comprehensive study published after the Bills were introduced. In accordance with the Terezin Declaration, in 2010 the Czech government established the European Shoah Legacy Institute (ESLI) in Terezin to monitor the progress and advocate for the principles of the Terezin Declaration.7 In fulfillment of its mission, ESLI commissioned in 2014 the Holocaust (Shoah) Immovable Property Restitution Study (the “Study”). Published on April 24, 2017,8 the Study is the comprehensive compilation of all significant legislation passed by the 47 states since 1945, dealing with the return or compensation of land and businesses confiscated or otherwise misappropriated during the Holocaust era. 9

According to the Executive Summary of the Study, Jewish and non-Jewish claimants, heirs, governments, NGOs, and other stakeholders will now have a one-stop resource where all significant Holocaust restitution legislation and case law dealing with immovable property over the last 70 years has been compiled and analyzed.

Therefore, any report pursuant to HR 1226 would substantially duplicate the ESLI’s Study Report. The cost of a US Secretary of State report is estimated by the Congressional Budget Office to be less than $500,000. That money would be wasted because most of the work has already been done. Therefore, the Bills’ duplicative objectives represent waste of government money.

7 See the ESLI website: http://shoahlegacy.org

8 According to the World Jewish Restitution Organization website, the Holocaust (Shoah) Immovable Property Restitution Study was published on April 24, 2017.

9 http://shoahlegacy.org/property-issues/immovable-property/immovable-property-study-2014-2017. Prof.

Michael J. Bazyler and Lee Crawford-Boyd led the project, which brought together the research efforts of over 40 pro bono attorneys from major global law firms, including White & Case, O’Melveny & Myers, Morgan Lewis, Fried Frank, and Brownstein Hyatt Farber & Schreck. These pro bono attorneys, under the guidance of Firm directors and associates, completed research reports addressing the status of restitution legislation in an assigned Terezin Declaration country. In addition, the reports provide a preliminary analysis of the country’s compliance with its Terezin Declaration commitments. The Study is available in three versions: The first one is a 1200 page interactive PDF document that can be downloaded in full from this website; the second is an interactive map organized from which individual country reports can be downloaded; and the third is a hard-copy publication of the study through Oxford University Press, which we consider an enormous achievement confirming the high quality and standard of the study.

- GENOCIDE DENIAL UNDERLINES THE PREMISE OF THE BILLS

It shall be noted that the Executive Summary of the Study states” “In the aftermath of the Holocaust, returning victims – not only surviving European Jews but also Roma, political dissidents, homosexuals, persons with disabilities, Jehovah’s Witnesses, and others – had to navigate a frequently unclear path to recover their property from governments and neighbors who had failed to protect them, and often, who had been complicit in their persecution.”10

The above statement is of great significance and real concern to the Polish Americans because it excludes from the definition of victims the second-largest group of WWII German genocide, i.e. ethnic Poles. These victims are either omitted all together or covered under “others.” Such omission of this important ethnic group is not coincidental considering that almost half of all Holocaust (Shoah) restitution claims under the Terezin Declaration are against Poland.

It shall be noted that Poland was the greatest victim of WWII in terms of the loss of human life and treasure. In 1939 Hitler declared: “The destruction of Poland shall be the primary objective. The aim is elimination of living forces, not the arrival at a certain line.” About 3 million of ethnic Poles and 3 million of ethnic Jews perished in WWII. About 40% of Poland’s national assets were destroyed. Most of the Polish industry and infrastructure had been lost. Warsaw and many other cities were leveled to the ground through wanton destruction and devastation.

The marginalization of the Polish victims, diminishing of their suffering, and suppression of their voice by proponents of the Holocaust (Shoah) restitution claims is directed against the second most persecuted ethnic group by Nazi Germany. Such treatment of the Polish victims of German WWII genocide borders on genocide denial and is not only illegal but also morally repugnant, grossly unjust, and hence contradictory to the stated objectives of the Bills.

________________________________________________________________________________________________

RECOMMENDATION

Considering all the above, I urge you, Sir, to vote against H.R. 1226.

Furthermore, I strongly suggest that an Envoy for WWII Genocide on Ethnic Poles be established at the same administrative level as the Holocaust Envoy. Such Envoy on Polish Holocaust shall be consulted on any WWII restitution issues, whether against Poland or on behalf of Poland.

Respectfully yours,

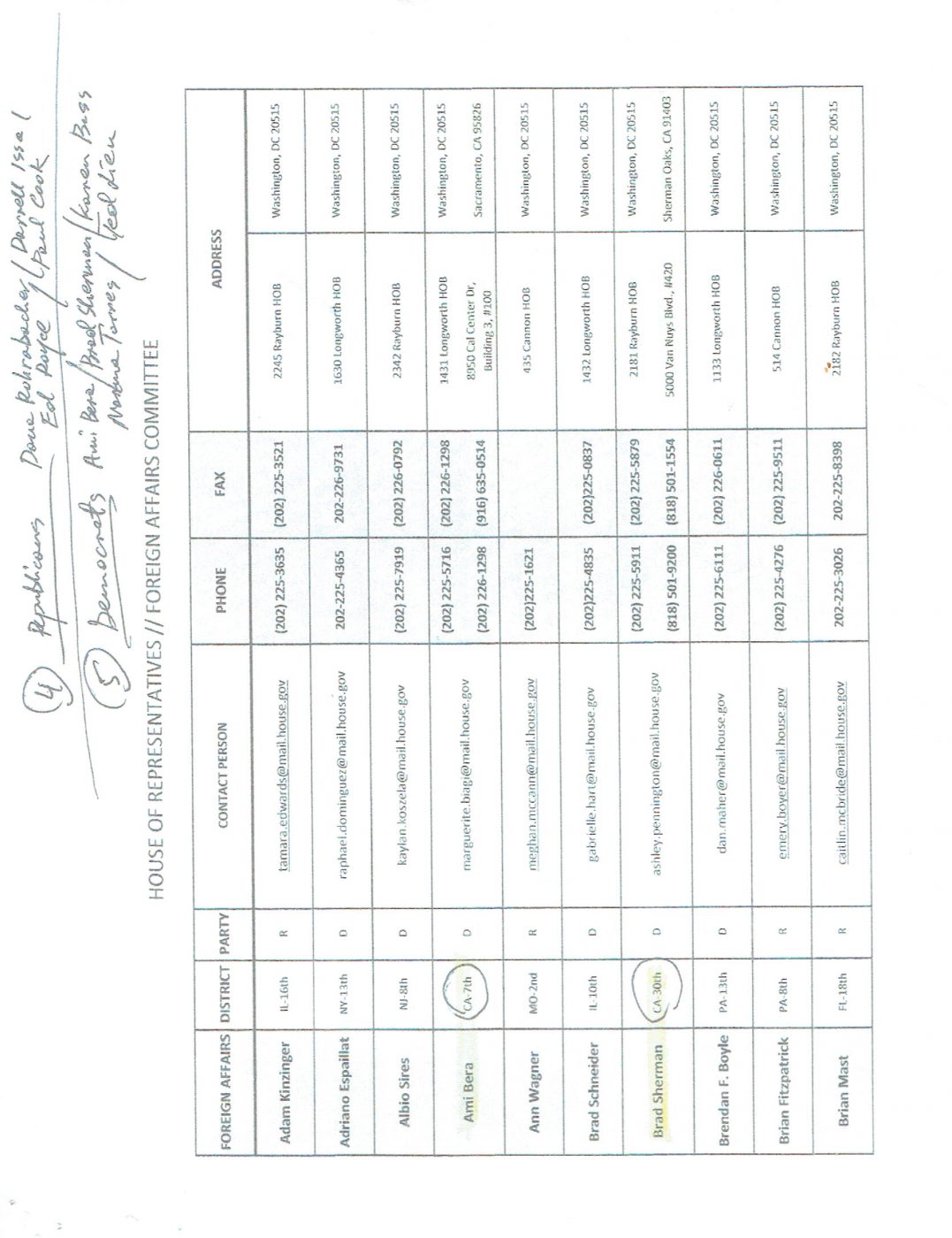

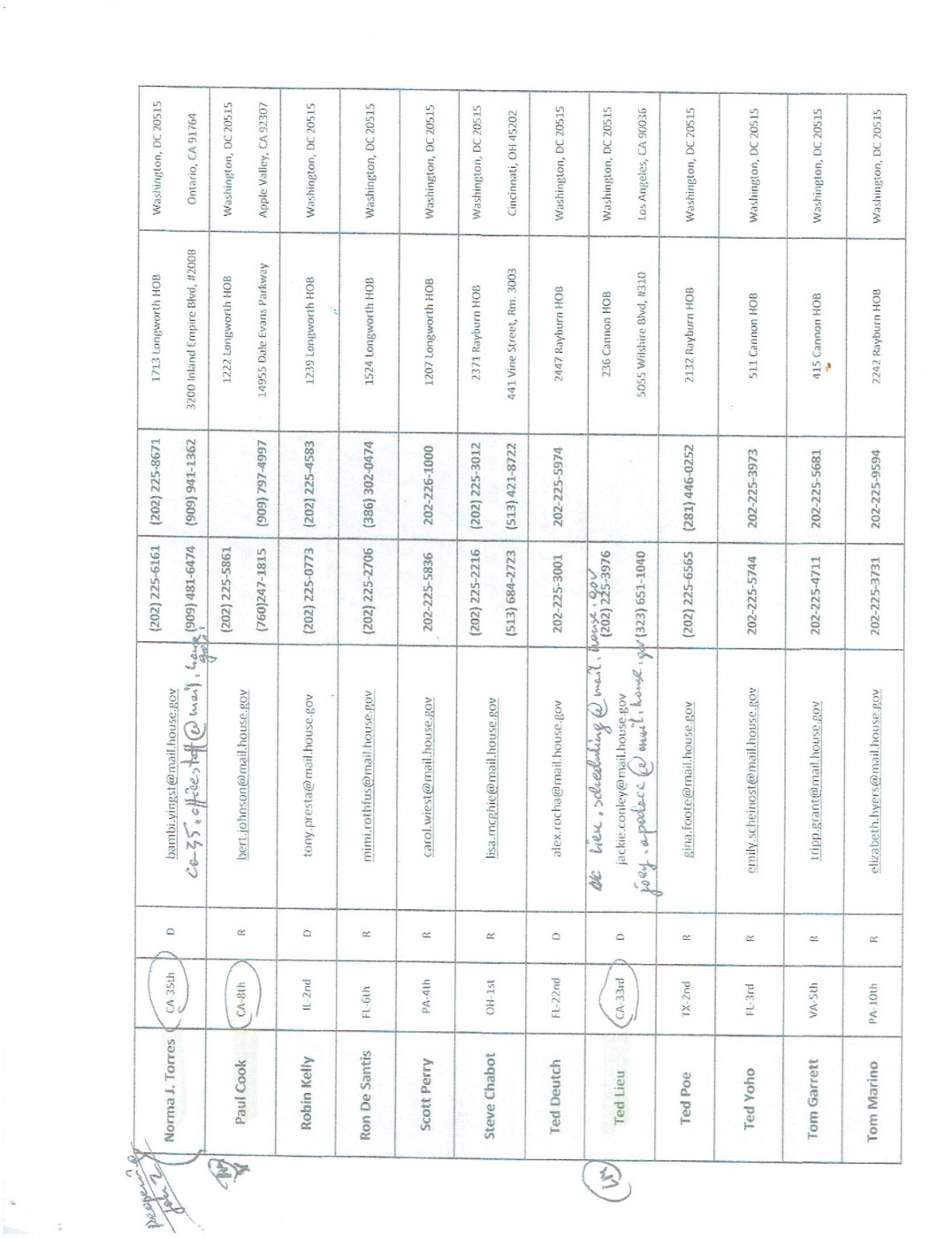

6. List of Congressmen on House Foreign Affairs Committee

7. Suggested script when writing to Congressman with legal objections:

(Your name and address):

……………………………………………………….

……………………………………………………….

To The Honorable, ………………………………………………., House of Representatives, Foreign Affairs Committee,

Dear Sir (Madame),

On December 12, 2017, the U.S. Senate approved Bill S.447, known as “the Justice for Uncompensated Survivors Today (JUST) Act of 2017”.

Now, House Bill H.R.1226, which mirrors U.S. Senate Bill S.447, is awaiting evaluation by the House Foreign Affairs Committee.

Attached is an independent legal evaluation of the proposed House Bill H.R.1226 that I am respectfully submitting for your review. It is my firm position that H.R.1226 is logically and legally flawed, per the attached legal analysis.

I urge you to reject H.R.1226.

Very truly yours,

Another suggested script when calling or e-mailing your congressman:

My name is _________.

Mr(s). ________ is my congressman.

(My family and I participated in helping _______ to be elected

and we made donations during his(her) campaign).

As a Polish American, I am concerned about the proposed bill H.R. 1226.

It is of great importance to me that the JUST ACT will not be applied to Poland.

Poland cannot be treated as villain in the matter of restitution

of or compensation for property confiscated by forcibly-imposed

external regimes during the period from 1939 to 1989.

(I would like to know when I, as a Polish American, could meet

with you and present my arguments.)

My email address _______ and tel. No ________.

Thank you for your attention.

The Polish American Congress (PAC) is a U.S. umbrella organization of Polish-Americans and Polish-American organizations. Its membership is composed of fraternal, educational, veterans, religious, cultural, social, business, and political organizations, as well as individuals.

The Polish American Congress (PAC) is a U.S. umbrella organization of Polish-Americans and Polish-American organizations. Its membership is composed of fraternal, educational, veterans, religious, cultural, social, business, and political organizations, as well as individuals.